If you have a job that takes care of your medical needs, consider yourself lucky as medical costs are only getting more expensive and unaffordable by the day! Despite having employee medical insurance, do you still need personal medical insurance?

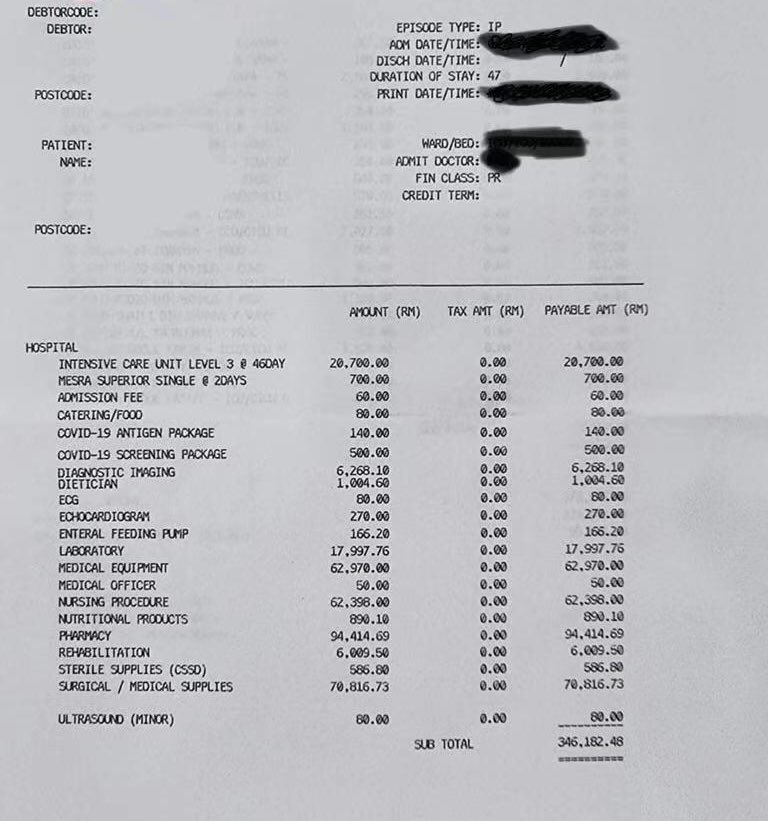

Just recently, an RM346K hospital bill of a Covid-19 patient admitted to ICU for 46 days made rounds on social media, shocking netizens with some saying that they could get a house with that amount!

But since you’re already covered by your employer, there’s really no need to worry. Right?

Not really.

Here are 3 reasons why you still need personal medical insurance:

1. You may not stay with your company forever

You’re only covered for as long as you’re with your company. That said, as soon as you leave the company for good, poof – there goes the benefit!

Even if your company is your ride-or-die, and you pledge to stay with it forever, sorry to break this to you, but there’s no obligation on their side to keep you forever. So what would be your Plan B?

2. Your group medical insurance may not be sufficient

Compared to personal plans, group medical insurance plans usually have a lower annual limit i.e. the maximum amount that insurance will cover in a year. This means that group medical insurance coverage amount is usually lower, and therefore may not be sufficient to totally cover your medical bills.

Scenario: You’re admitted to a hospital for a minor knee surgery. When the hospital bill totalling RM20,000 gets to your hand, you’re stunned by the amount but relieved that you’re covered under group medical insurance. But little did you realize that your group medical insurance annual limit is only RM10,000!

If the above were to happen to you (touch wood!), what would be your plan?

In that unfortunate case, you may have to pay the bills out of your own pocket.

3. (Bonus!) You can enjoy RM3,000 of income tax relief

If you’re earning an annual income of RM34,000 a year or roughly RM2,833.33 a month (after EPF deductions), it’s mandatory for you to file income tax.

Since you’re gonna have to pay taxes anyway, getting medical insurance will just mean that the money that’s supposed to just go into the taxes will be ‘reinvested’ into protection for yourself. So it’s a win-win!

To get or not to get personal medical insurance?

There are so many reasons why you should get personal medical insurance. And because of these reasons, you’ve probably been approached by insurance agents a million times to get one for yourself.

Whatever the case, please ensure that you make informed decisions before buying considering medical insurance.

Bjak is one of Malaysia’s biggest insurance comparison sites, with more than 10 insurance brands to choose from. Get your free insurance quote at Bjak today!

WhatsApp

WhatsApp

Messenger

Messenger